Wyoming Credit: Reliable Financial Solutions for Every Stage of Life

Wyoming Credit: Reliable Financial Solutions for Every Stage of Life

Blog Article

Experience the Distinction With Lending Institution

Membership Advantages

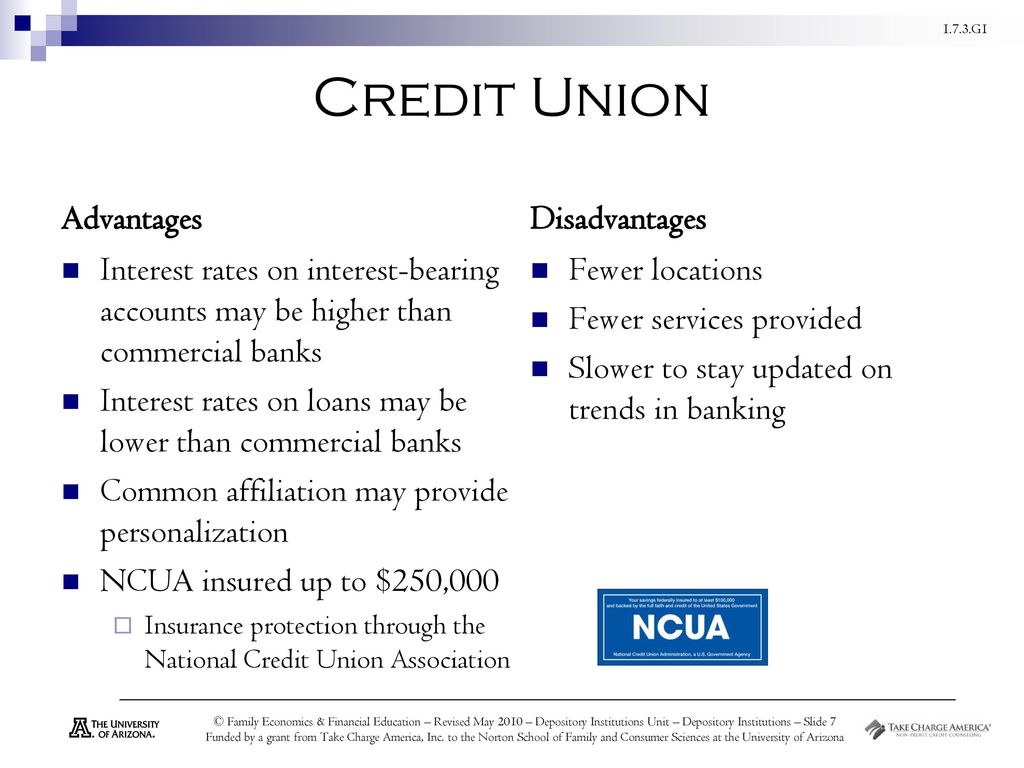

Lending institution supply a variety of valuable benefits to their participants, distinguishing themselves from traditional financial institutions. One essential advantage is the emphasis on participant possession and autonomous control. Unlike financial institutions, credit scores unions are possessed by their participants, that likewise have ballot legal rights to elect the board of directors. This member-centric approach often converts into much better rates of interest on cost savings accounts, reduced loan rates, and decreased charges compared to for-profit financial institutions.

One more substantial advantage of credit rating unions is their focus on area participation and assistance. Lots of cooperative credit union proactively take part in area growth projects, economic education programs, and philanthropic initiatives. By cultivating a strong feeling of area, lending institution not just offer economic services but additionally add to the general wellness and prosperity of the communities they serve.

In addition, cooperative credit union focus on economic education and empowerment (Credit Union Cheyenne). They use resources and advice to help participants make informed choices about their financial resources, boost their credit rating, and achieve their long-term financial objectives. This dedication to education and learning collections lending institution apart as relied on financial partners dedicated to the monetary health of their members

Customized Customer Care

Supplying tailored help and customized attention, lending institution stand out in giving tailored client service to their members. Unlike conventional banks, credit unions prioritize developing solid relationships with their participants, concentrating on comprehending their distinct needs and financial goals. When a participant interacts with a credit history union, they can anticipate to be treated as a valued person instead than simply an account number.

Cooperative credit union frequently have local branches that permit in person interactions, enhancing the personal touch in client service. Participants can speak directly with knowledgeable team that are devoted to assisting them navigate financial choices, whether it's opening a brand-new account, getting a funding, or seeking suggestions on managing their financial resources. This customized method collections lending institution apart, as members really feel supported and empowered in achieving their monetary goals.

In addition, lending institution also use practical digital financial services without jeopardizing the personal link. Participants can access their accounts on the internet or through mobile apps while still getting the exact same degree of customized aid and treatment.

Affordable Rate Of Interest Rates

When looking for financial items, participants of lending institution take advantage of competitive rate of interest that can improve their cost savings and obtaining opportunities. Credit report unions, as not-for-profit banks, often use extra beneficial interest prices contrasted to traditional financial institutions. These competitive rates can relate to different economic items such as savings accounts, certifications of deposit (CDs), individual loans, mortgages, and credit score cards.

One of the essential benefits of lending institution is their concentrate on offering participants as opposed to maximizing revenues. This member-centric method permits credit scores unions to prioritize offering reduced rate of interest prices on finances and greater rate of interest on interest-bearing accounts, offering members with the possibility to expand their money better.

Furthermore, lending institution are recognized for their willingness to collaborate with participants who might have less-than-perfect credit report histories. Despite this, cooperative credit union still strive to maintain affordable rate of interest, guaranteeing that all participants have accessibility to budget-friendly economic solutions. By making use of these competitive passion prices, credit report union members can take advantage of their funds and attain their cost savings and obtaining objectives much more successfully.

Lower Costs and Prices

One significant function of credit history unions is their dedication to decreasing charges and costs for their members. Unlike conventional banks that often prioritize making the most of earnings, cooperative credit union run as not-for-profit organizations, permitting them to supply a lot more beneficial More Help terms to their members. This difference in structure equates to decrease fees and decreased expenses throughout numerous services, profiting the click to investigate participants directly.

Credit rating unions commonly bill reduced account upkeep fees, overdraft fees, and atm machine costs compared to business financial institutions. Additionally, they typically supply higher interest prices on interest-bearing accounts and lower rate of interest on loans, causing general price savings for their members. By keeping fees and expenses at a minimum, cooperative credit union aim to supply monetary services that are accessible and economical, promoting a more inclusive financial atmosphere for individuals and neighborhoods.

In significance, choosing a lending institution over a typical bank can result in significant expense financial savings with time, making it an engaging option for those looking for an extra affordable strategy to banking solutions.

Neighborhood Involvement

With a solid emphasis on promoting close-knit connections and sustaining local efforts, debt unions actively engage in area participation campaigns to equip and boost the areas they serve. Community involvement is a keystone of lending institution' worths, mirroring their commitment to returning and making a positive effect. Cooperative credit union usually join numerous area tasks such as volunteering, sponsoring local occasions, and offering financial education programs.

By actively taking part in community events and campaigns, credit history unions show their devotion to the health and prosperity of the communities they offer. This participation surpasses just economic deals; it showcases a real rate of interest in developing strong, sustainable areas. Through collaborations with local companies and charities, cooperative credit union add to boosting the lifestyle for citizens and promoting a sense of unity and assistance.

Furthermore, these neighborhood involvement initiatives help to index create a favorable image for credit score unions, showcasing them as trusted and dependable partners purchased the success of their participants and the community at big. Overall, area participation is a vital facet of lending institution' procedures, enhancing their commitment to social duty and neighborhood advancement.

Final Thought

In verdict, cooperative credit union use many advantages such as democratic control, much better rate of interest, lower funding rates, and decreased charges contrasted to for-profit banks. With personalized consumer solution, affordable rates of interest, lower charges, and a commitment to neighborhood involvement, lending institution give an unique value suggestion for their members. Emphasizing monetary empowerment and area advancement, lending institution stick out as a beneficial choice to typical for-profit financial institutions.

Report this page